While many apartment markets around the country, like Phoenix or Las Vegas, have gone through boom and bust cycles as supply and job growth ebbs and flows, the Washington, D.C., metro area has stood as a safe haven for apartment owners.

With the federal government and the contracting industry providing steady employment, multifamily executives knew there would be a strong baseline of demand in and around the city, even if new deliveries were high.

But times are changing.

Since Inauguration Day, the new Trump administration and Elon Musk’s Department of Government Efficiency have punctured that sense of security long enjoyed by both residents and landlords in the nation’s capital, firing at least 101,022 federal workers around the country, according to CNN. President Donald Trump says thousands more are yet to come, many of them targeting Washington-based workers.

Many of those firings, which have focused on probationary employees with one or two years in their roles and fewer protections, are now being litigated in the courts.

Although apartment leaders and REIT executives on recent fourth-quarter earnings calls say they haven’t yet seen major impacts from the DOGE layoffs on their portfolios, they’re concerned about the effects of the cuts. Still, some take solace that the Washington region’s economy has diversified over the past few decades and that many remaining federal workers are returning to their offices.

Too early to tell

As of December, there were 300,000 federal government jobs located in the Washington, D.C., metropolitan area, according to the Federal Reserve Bank of St. Louis and U.S. Bureau of Labor Statistics.

A lot of those positions could be vulnerable.

“Based on current information, we believe potentially 100,000 federal government positions may be at risk in the region,” said TJ Parker, senior vice president of research and data analytics at Greensboro, North Carolina-based apartment owner and operator Bell Partners. “It is simply too early to quantify the full impacts on multifamily housing, and we are closely monitoring any changes to that workforce and its impact.”

TJ Parker

Permission granted by Bell Partners

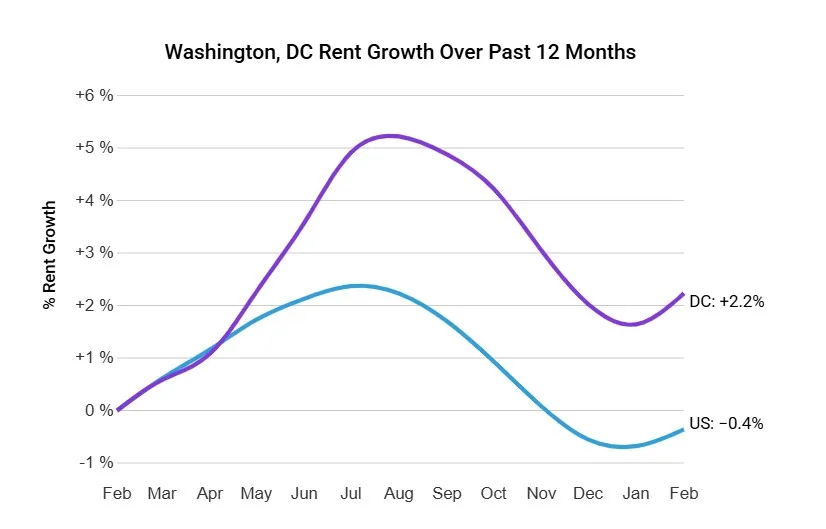

Coming into the year, many companies considered the Washington metro area among their top markets. The region was Equity Residential’s top-performing market, with 4.2% revenue growth in the fourth quarter of 2024, and the firm still has high expectations for 2025 with 97% projected occupancy, chief operating officer Michael Manelis said on the firm’s fourth-quarter earnings call in February.

“The wild card here is what impact the new administration and its focus on both cost-cutting and a return-to-office policy for federal employees will have on the local job market,” Manelis said.

Others are also in wait-and-see mode. A spokesperson for Charleston, South Carolina-based Greystar, the largest multifamily owner, manager and developer in the U.S., told Multifamily Dive that it is too early to tell what, if any, impact there will be from the layoffs.

A sense of concern

Like its peers, Bethesda, Maryland-based apartment owner CAPREIT has yet to see any significant impact from the federal layoffs. But the firm is still wary of potential fallout.

“Considering the scope and scale of the layoffs that Musk/Trump have initiated in the past few weeks, CAPREIT is concerned about the short-term impact to apartment occupancies in the D.C. metropolitan area,” CEO Andrew Kadish told Multifamily Dive.

However, Bell’s Parker said that permanent job cuts could actually boost apartment rental rates in the market from an increase in short-term leases. In the long term, it would drive people to lower-cost areas, reducing housing demand around the nation’s capital.

Andrew Kadish

Permission granted by CAPREIT

“Combined with the current slowdown in private-sector hiring, laid-off government employees could face challenges finding another job in the region,” Parker said. “Any migration away from the region would benefit other markets.”

Manelis said EQR hasn’t yet seen job cuts affect its renewals in the Washington, D.C., area, but he also admits there’s concern. “I think everybody is still a little bit on edge,” he said.

Beyond pure layoffs, Kadish sees other risks to his portfolio in federal cost-cutting, including DOGE’s push to sell or break leases at buildings occupied by federal agencies.

“Another DOGE measure that could affect CAPREIT’s affordable portfolio would be the termination of leases for federal buildings, which would significantly impact clerical and janitorial staff at these buildings,” he said.

Competing crosscurrents

As the Trump administration looks to cut federal jobs, it’s also asking workers to return to the office. EQR executives wonder if those in-person policies may ultimately neutralize the effects of layoffs.

“Those people that are far away are not currently renters from us, and [they] may be new renters soon for a portfolio that has very little slack in it already,” CEO Mark Parrell said on EQR’s Q4 earnings call.

States/territories with the most federal jobs as of December 2024

| Location | Jobs |

| District of Columbia | 162,144 |

| California | 147,487 |

| Virginia | 144,483 |

| Maryland | 142,876 |

| Texas | 129,738 |

| Florida | 94,014 |

| Georgia | 79,686 |

| Pennsylvania | 66,079 |

| Washington | 56,772 |

| Ohio | 55,487 |

SOURCE: U.S. Office of Personnel Management (OPM), FedScope

Camden Executive Vice Chairman of the Board Keith Oden thinks federal return-to-office policies could boost the Houston-based REIT’s properties inside Washington, D.C., which has been the weak link in its capital region portfolio.

“It could very well be that as people have to return to work in an actual office, a preponderance and a big portion of which are in D.C. proper, that it’s going to make more sense for them to potentially move back closer to or into D.C. proper,” Oden said on the REIT’s Q4 earnings call.

Overall, Oden sees “a lot of crosscurrents” in the nation’s capital. “I think you’re probably never going to go broke betting on the under on how many federal employees are actually going to go do something else, regardless of who asked them to do so,” he said.

Market diversification helps

On Bethesda, Maryland-based REIT’s Elme Communities Q4 earnings call in February, President and CEO Paul McDermott took an optimistic tone, pointing out that Washington, D.C., was a top-performing market in 2024 and is still trending that way for 2025.

“Net inventory ratios remain low, and the high cost of housing creates sustained demand for value-oriented rental options,” McDermott said. “The region is positioned to continue to thrive, offering a highly skilled workforce, advanced technology infrastructure, an entrepreneurial atmosphere and unmatched global connections.”

Ric Campo

Permission granted by Camden Property Trust

Pointing to market diversification, McDermott said that industries other than the federal government have driven almost 97% of job growth over the last 12 months.

“I think now technology has really taken over, and we really are still seeing tremendous amounts of growth, especially in Northern Virginia, where the bulk of our residential portfolio in the DMV is located,” McDermott said.

Parrell also sees the economic diversification in the nation’s capital as providing some buffer against DOGE job cuts. “There are other employers [in the Washington, D.C., area],” he said. “There’s a lot, by the way, of defense industry-related stuff, which may not be subject to the same staffing restrictions.”

Transaction market uncertainty

Despite the layoffs, Kadish said CAPREIT, a family-owned Washington, D.C.-area firm, thinks the market will continue to be coveted by institutional investors due to its career opportunities in medicine, academia and the government sectors and the lack of affordable housing.

“These layoffs do not change how CAPREIT looks at the D.C. region in the long term,” he said.

Camden, which was seeking to lower its property allocation in the Washington, D.C., area long before Trump won a second term, also sees strong investor demand for apartments in the region.

Optional Caption

“D.C. is a great transaction market,” Camden CEO Ric Campo said on the REIT’s recent Q4 earnings call. “Depending on the property, [cap rates are] in the mid or high 4s plus or minus. So there’s still a decent demand there.”

However, the near-term uncertainty could be a hurdle for some. In February, Elme Communities announced that it “initiated a formal evaluation of strategic alternatives,” which could include a sale. In a research note shared with Multifamily Dive, Anthony Paolone, executive director at JPMorgan, indicated possible federal cuts might be an obstacle.

“What has given us some pause of late is the Trump administration and its efforts to reform the government/DOGE,” Paolone wrote. “This could create some uncertainty around demand and pricing power, resulting in some natural buyers pausing.”

Right now, though, apartment operators, owners and potential buyers in Washington, D.C., may just need to wait it out for more clarity. “We just kind of need to see how this plays out over the course of the next couple of months,” EQR’s Manelis said.

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.